Great Throughts Treasury

This site is dedicated to the memory of Dr. Alan William Smolowe who gave birth to the creation of this database.

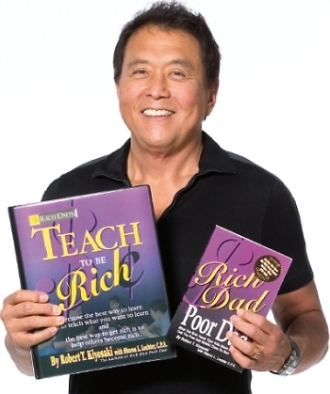

Robert Kiyosaki, fully Robert Toru Kiyosaki

American Businessman, Investor, Financial Literacy Activist, Motivational Speaker and Best-Selling Author of "Rich Dad, Poor Dad" books

"Money is not the goal. Money has no value. The value comes from the dreams money helps achieve."

"Money is one form of power. But what is more powerful is financial education. Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth. The reason positive thinking alone does not work is because most people went to school and never learned how money works, so they spend their lives working for money."

"Money is really just an idea."

"Money only accentuates the cash-flow pattern running in your head. If you pattern is to spend everything you get, most likely an increase in cash will only result in an increase in spending."

"Money will never make you happy if you are an unhappy person."

"Money problems make you smarter? if you solve your money problems, your financial intelligence grows. When your financial intelligence grows, you become richer. If you do not solve your money problem, you become poorer. If you do not solve your money problem, that problem often grows into more problems. If you want to increase your financial intelligence you need to be a problem solver. If you don?t solve your money problems you will never be rich. In fact, you will become poorer the longer the problem persists."

"Money, financial skills, are not taught at school."

"More important than the HOW we achieve financial freedom, is the WHY. Find YOUR reasons why you want to be free and wealthy."

"Most businesses think that product is the most important thing, but without great leadership, mission and a team that deliver results at a high level, even the best product won't make a company successful."

"Most investors say "Don?t take risks." The rich investor takes risks."

"More money will not solve the problem if you have the wrong money blueprint ? most people, given more money, only get into more debt."

"Most financial writers may be well educated but not necessarily financially successful."

"More money will often not solve the problem. In fact, it may compound the problem. Money often makes obvious our tragic human flaws, putting a spotlight on what we don?t know. That is why, all too often, a person who comes into a sudden windfall of cash?let?s say an inheritance, a pay raise, or lottery winnings?soon returns to the same financial mess, if not worse, than the mess they were in before."

"Most employees only want to know how much they get paid and how much time off they get - they probably don't have the mission in their souls."

"Most of the people that they wanted from each of the earth to change, but themselves, and it's left for you to change yourself to change for anyone."

"Most of us are aware of the sacrificial slaughter of Bear Sterns. Some people call it a bailout, but I call it a handout - a government handout to some of the richest people on Earth, paid for by American taxpayers."

"Most of the time not talking life and you, but your pay, in a way, but every impulse is to say life as you wake up, there is something i want him to teach you."

"Most of us know that goals are important. I?m sure that most of us know that people who make the effort to write down their goals are more successful than people who don?t. If this is true, I wonder why people don?t focus more on their goals? I believe the spiritual nature of goal setting has allowed Kim and I to live a life far beyond our wildest dreams."

"Most people can be bought ? they have a price, because of human emotions called FEAR and GREED. First, the fear of being without money motivates us to work hard, and then once we get that paycheck, greed starts us thinking about all the wonderful things money can buy. The pattern is then set. They?re in the Rat Race."

"Most people are trapped in the Rat Race for the rest of their lives!"

"Most people are happy being average. Most are happy being faceless in a sea of faces."

"Most people are afraid of failing and being rejected. Get over these two things, and life is easy!"

"Most people go along with the crowd. They do things because everybody else does it."

"Most people fail to realize that in life, it?s not how much money you make, it?s how much money you keep."

"Most people grow up in a family where they didn?t have much money ? that became their reality. Most of us live by ideas passed on down by our parents."

"Most people have the opportunity of a lifetime flash right in front of them, and they fail to see it. A year later, they find out about it, after everyone else got rich."

"Most people invest money and do not invest much time. Donald [Trump] and I invest a lot of time before we invest much money. We prepare to invest. I realized that entrepreneurship is not risky. Being unprepared is risky."

"Most people spend their health to gain wealth. Then they spend their wealth trying to get back their health."

"Most people never get wealthy simply because they are not trained financially to recognize opportunities right in front of them. The rich have learned to recognize opportunities as well as how to create them."

"Most people look for the easy road to wealth, because they lack a strong enough why. The easy road ALWAYS leads to a dead end."

"Most people spend their lives building financial houses of straws, which are susceptible to wind, fire, rain and big bad wolves."

"Most people prefer to live within your means to expand their means."

"Most people never see the trap they are in. Every morning, they get up, they get ready, and hurry out to work. Do they look happy to you? Why do they do it? Because everybody else is."

"Most people want everyone else in the world to change themselves. Let me tell you, it?s easier to change yourself than everyone else."

"Most people work very hard, for little money, clinging to the illusion of job security, looking forward to 3-week vacation each year and a skimpy pension after 45 years of work. If that excites you, go for it."

"Most savers do not use financial leverage."

"Most shareholders have little if any control over the companies in which they own stock, even if they own a million shares."

"Most small-business owners have no financial education when they started. They weren't trained to be entrepreneurs."

"My company survives because I've learned to respect the ideas of people younger than me and recognize when my wisdom is obsolete."

"My Dad seemed comfortable with his decision to be a 'have-not,' but I knew that I wasn't."

"My family wasn't rich, so when it comes to money, I tend to think, 'Err on the side of caution.'"

"My investment career had begun. More important, I was training my brain to see what most people don?t see."

"My parents were very active in my education; otherwise I would have flunked out. I would have been a juvenile delinquent probably."

"My measure of success is whether I'm fulfilling my mission."

"My Poor Dad was crushed by the new economy. He chose financial security rather than financial freedom ? and in the end, he had neither."

"My Poor Dad would say, ?I can?t afford it,? while my Rich Dad would say, ?How can I afford it?"

"My Poor Dad always said, ?My house is an asset and it's our largest investment.? My Rich Dad said, ?Your house is not an asset, it's a liability. And if it's your largest investment you're in trouble.?"

"My Rich Dad believed we should all learn to take care of ourselves."

"My partner Donald Trump says that married couples should always have a prenuptial agreement. True, a prenuptial is important if one partner is much richer than the other before marriage, but Kim and I don't have one."

"My Rich Dad taught me to focus on passive income and spend my time acquiring the assets that provide passive or long term residual income... passive income from capital gains, dividends, residual income from business, rental income from real estate, and royalties."