Great Throughts Treasury

This site is dedicated to the memory of Dr. Alan William Smolowe who gave birth to the creation of this database.

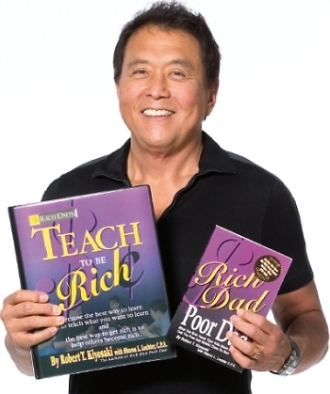

Robert Kiyosaki, fully Robert Toru Kiyosaki

American Businessman, Investor, Financial Literacy Activist, Motivational Speaker and Best-Selling Author of "Rich Dad, Poor Dad" books

"In a true investor?s mind, it takes too much time to find a good investment, so they would rather buy and hold."

"In business, success often depends upon the relative age of your ideas."

"In July of 2005 the government of Japan informed its younger workers that they will have to pay more in taxes to pay for the older workers? retirement. We in America may be getting the same news in a few years."

"In military school, on day one you must memorize the mission of the Merchant Marine Academy."

"In business, they say, ?If you aren?t the lead dog, the view is the same.? They also say, ?Second place is the first loser.?"

"In most cases, is not smart from his peers than in real life, but the stubborn of them is doing it."

"In life, it?s not how much money you make that counts, but how much you keep."

"In many ways, learning from my mistakes and taking responsibility for my mistakes was the best education I could have asked for. If I had not learned from my mistakes I would not be where I am today."

"In my environment today money is not a dirty word. Getting rich is fun, and investing is a game. Rather than living below our means, we constantly work on expanding our means, increasing our income, building assets and serving as many people as we can. Also we keep financially negative people out of our lives and surround ourselves with like-minded people who challenge and support us. Our friends are also a part of our environment."

"In my experience, many people confuse being cowardly with being nice."

"In my opinion, a quitter is someone who quits simply because things have gotten tough."

"In my reality a winner also knows when to quit. Sometimes in life, it is best to cut your losses. It is best to admit you have come to a dead end or to admit you have been barking up the wrong tree."

"In my seminars, I am often asked, ?Why don?t more people invest for cashflow? While I am certain there are many answers, I believe there is one primary reason? and that reason is, good cashflow at a good price is hard to find."

"In order to be a player on the fast track, you will need to have a plan on how to gain more and more control. On the fast track, it is control more than money that counts."

"In other works, we swallowed our pride and did whatever it took to make the extra money."

"In school we learn that mistakes are bad, and we are punished for making them. Yet, if you look at the way humans are designed to learn, we learn by making mistakes. We learn to walk by falling down. If we never fell down, we would never walk."

"In the Industrial Age the ticket for success was to go to school, get good grades, and find a safe secure job for life. You did not have to worry about your financial education because the company and the government would take care of you financially once your working days were over. The rules have changed. You can no longer rely on your employer or your government to take care of you."

"In real estate, many investors love triple net leases (NNN). With NNN?s investors receive income without the expenses of taxes, repairs and insurance. The tenant covers these costs."

"In the real world, courage is more important than good grades. It takes courage to discover, develop and donate your genius to the world."

"In spite of rising unemployment and the loss of traditionally safe jobs, like a monkey clinging to his fruits and nuts, people are returning back to school to train for a new job, higher pay, benefits and a good pension plan."

"In the real world, the smartest people are people who make mistakes and learn. In school, the smartest people don?t make mistakes."

"In the world of money and financial education, cashflow is the single most important world. Cash is always flowing. It is either flowing in, or it is flowing out. For most people, they work hard and the cash flows out. True financial education trains you to have cash flowing in. Financially educated investors must know the difference between cashflow and capital gains. Most uneducated investors invest for capital gains."

"In the world of money the rich are sellers and the poor and middle class are buyers."

"In the world of money and investing, you must learn to control your emotions."

"In the simplest terms, inflation occurs when there's too much money in the system. On the flip side, deflation occurs when there are too few dollars in circulation."

"In the world of money, business and investing, we have too many preachers."

"In their avoidance of risk, people lead lives of extreme risk."

"In today?s fast-changing world, it?s not so much what you know anymore that counts, because often what you know is old. It is how fast you learn."

"In today's fast-volatility does not matter what you do to recognize that something has mostly aging, but what is important is the extent of your speed in learning skills. Those are priceless."

"Inside each of us is a David and a Goliath."

"In today?s rapidly changing world, the people who are not taking risk are the risk takers."

"Instant gratification will kill your finances. Delay gratification!"

"Instead of labeling and discriminating against one or the other, we need to learn to blend our gifts and complement our geniuses."

"Inside of every problem lies an opportunity."

"Intelligence solves problems and produces money. Money without financial intelligence is money soon gone."

"Instead, to be financially free, we need to learn how to make mistakes and manage risk."

"Intelligence is the ability to take information and make it meaningful."

"Intelligence is not about memorizing old answers and avoiding mistakes ? behavior our school system defines as intelligent. True intelligence is about learning to solve problems in order to qualify to solve bigger problems. True intelligence is about the joy of learning rather than the fear of failing."

"Intelligent person welcomes new ideas because they add to the momentum of other ideas."

"Intelligent people should learn from their experiences. With people on the street, the bad experience has beaten them."

"Investing for capital gains is gambling."

"Invest for cashflow and you?ll never worry about money. Invest for cashflow, and you will not be wiped out in boom and bust markets. Invest for cashflow and you?ll be a rich man."

"Investing in mutual funds is investing at the end of the food chain."

"Investing is a continual process of searching, negotiating, financial and managing people and money."

"Is this elemental basis, or a combination of those skills."

"Israel will not tolerate Iran developing nuclear power, even if Iran claims it is for peaceful purposes. If there is an attack, oil prices will go through the roof."

"Investing is not risky. Investing is fun. Investing can make you very very rich. More importantly investing can set you free, free from the struggle of earning a living and worrying about money."

"It costs governments money to keep fuel prices low. Oil-rich Yemen, for instance, devotes 9 percent of its GDP to making sure its people don't riot when oil prices rise."

"It doesn?t matter which party is elected into office. If it?s Democrats, they will probably tax and spend. If it?s Republicans, they will probably borrow and spend."

"It does not take money to make money."